Banking

We understand the unique challenges and opportunities in the banking industry. Our team of experts can help you create a seamless and secure digital experience for your customers, from mobile banking apps to online platforms.

Agile Development

We use agile methodologies to ensure that we are constantly delivering value and meeting your expectations. We work in short iterations, with frequent feedback loops, to ensure that we are on track and addressing your needs throughout the development process. This approach also allows us to be flexible and adapt to changing requirements.

Security by Design

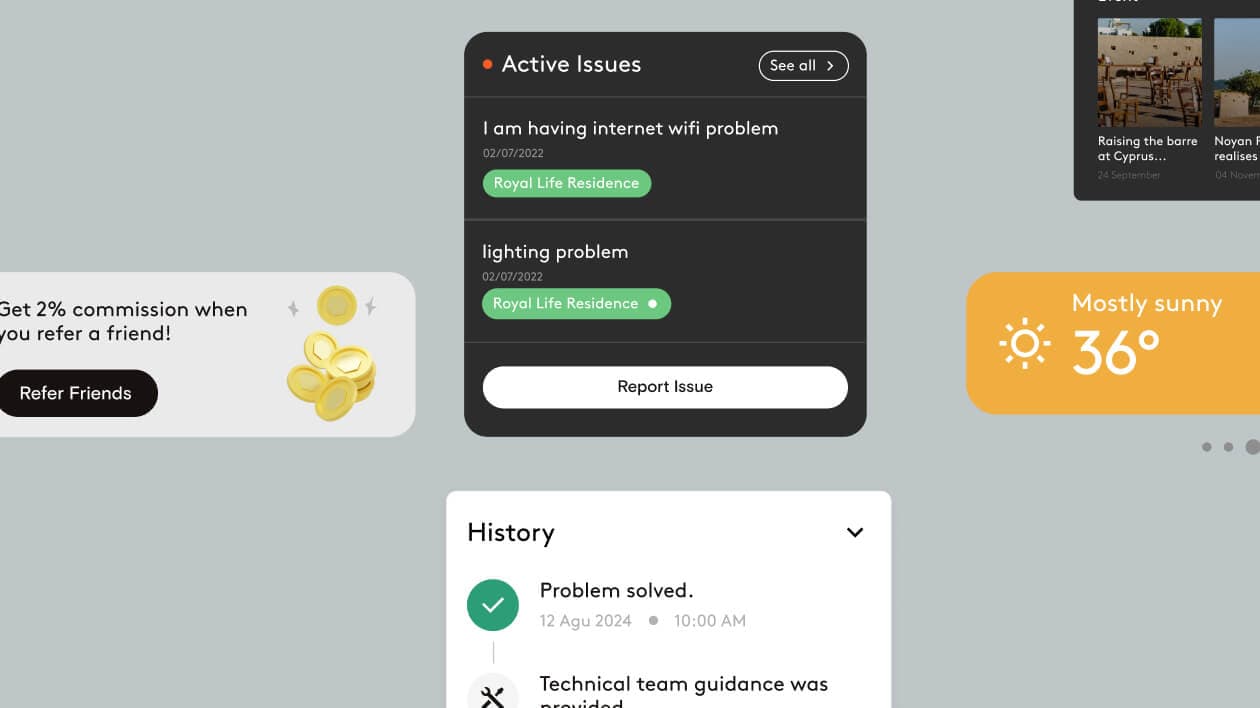

Security is built into every aspect of our development process. We use industry-standard security practices and technologies to protect your customers' data. This includes using encryption, secure authentication protocols, and regular security audits. We also work closely with you to ensure that your applications meet the highest security standards and comply with all relevant regulations.

User-Centric Design

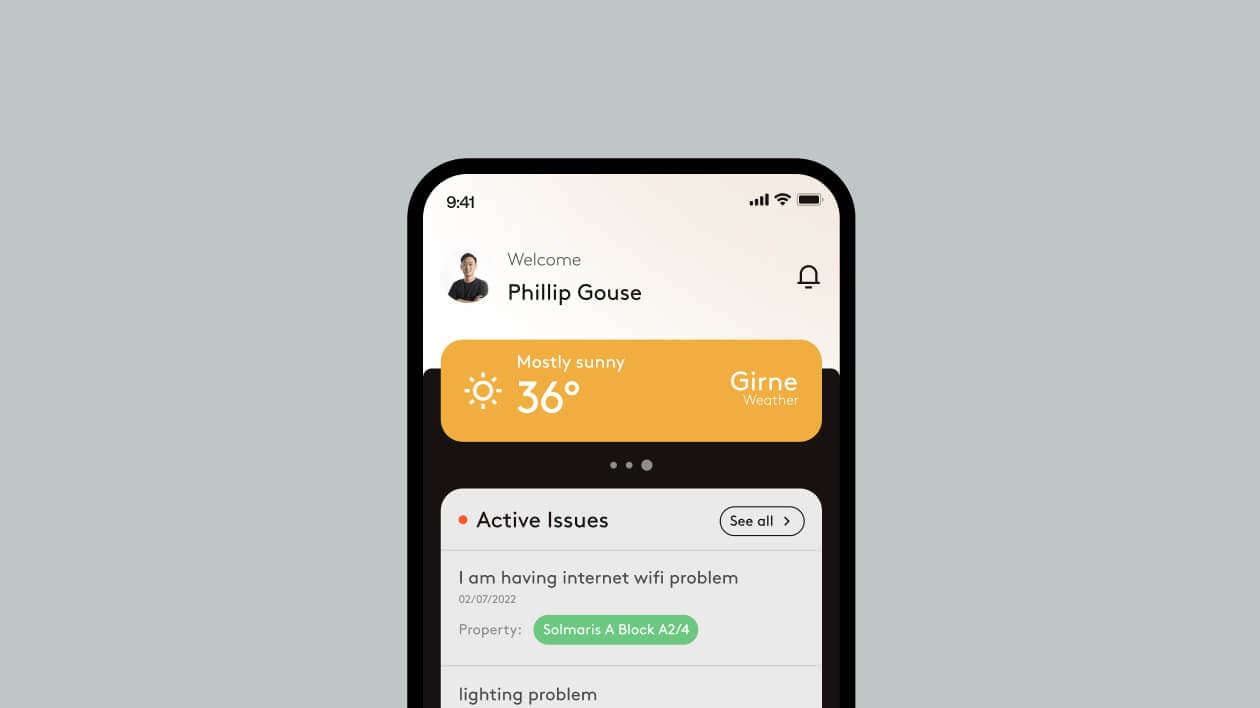

We believe that user experience is paramount in banking applications. We start by understanding your target audience and their needs, and we design solutions that are intuitive, user-friendly, and accessible to all. We use design thinking principles to ensure that our solutions are not only visually appealing but also functional and effective.

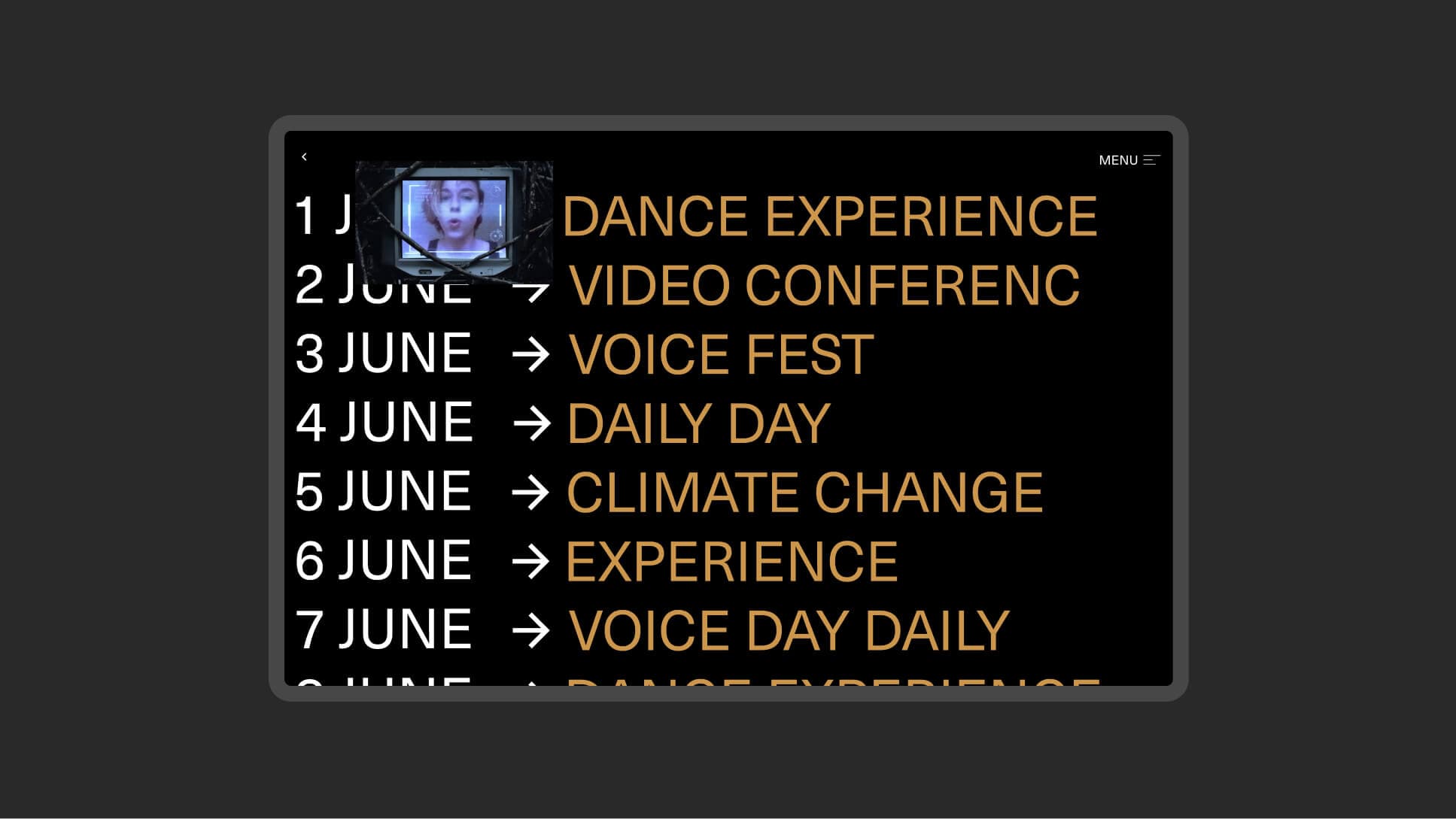

Design

We craft meaningful digital experiences that captivate and engage, blending creativity with strategy. From concept to execution, we make your brand stand out.

We shape distinctive brands that resonate, ensuring every element reflects your business’s core values.

Our branding process builds emotional connections, making your brand memorable and positioning it for long-term success in the market.

Yes, Saypr can seamlessly integrate with your existing banking systems. We have experience integrating with a wide range of banking systems, including core banking systems, payment gateways, and data management systems. We will work with you to ensure that the integration is smooth and efficient.

Yes, Saypr offers ongoing support and maintenance for your banking applications. We provide technical support, bug fixes, and updates to ensure that your application is always running smoothly. We also offer training and documentation to help you manage your application effectively.

Getting started with Saypr is easy. You can contact us through our website or schedule a free consultation to discuss your project. We will work with you to understand your needs and develop a plan that meets your goals.

We believe that a great customer experience is essential for any banking institution. We can help you improve your customer experience by developing user-friendly applications, providing excellent customer support, and integrating with other systems to create a seamless experience. We also offer data analytics services to help you understand your customers better and provide them with personalized services.

We believe that accessibility is essential for all banking applications. We follow industry best practices and guidelines to ensure that our applications are accessible to all users, regardless of their abilities. We also work with you to ensure that your application meets your specific accessibility requirements.

Scalability is essential for banking applications, which need to handle a large volume of transactions and users. We use cloud-based infrastructure and scalable architectures to ensure that your application can handle the demands of your business. We also work with you to develop a strategy for scaling your application as your business grows.

Security is paramount in banking applications. We employ industry-standard security practices and technologies to protect your customers' data. This includes using encryption, secure authentication protocols, and regular security audits. We also work closely with you to ensure that your applications meet the highest security standards and comply with all relevant regulations.

Data privacy and security are top priorities for Saypr. We comply with all relevant data privacy regulations, including GDPR and CCPA. We also use industry-standard security measures to protect your customers' data. We will work with you to ensure that your application meets the highest data privacy and security standards.

We help banks stay ahead of the competition by developing innovative solutions that meet the needs of their customers. We also provide consulting services to help banks understand the latest trends in the banking industry and develop a strategy to stay ahead of the competition.

User feedback is essential for developing successful banking applications. We use a variety of methods to collect user feedback, including surveys, usability testing, and customer support interactions. We then use this feedback to improve the user experience and make our applications more user-friendly.

We are constantly researching and staying abreast of the latest trends in the banking industry. Our team attends industry conferences, reads research papers, and follows industry publications to ensure that we are always up-to-date on the latest technologies and best practices. We are also committed to continuous learning and development, and we invest in training and development programs for our team.

Saypr has developed a wide range of banking applications for clients across the globe. We have experience developing mobile banking apps, online banking platforms, payment processing systems, and fraud detection systems. We can provide you with case studies and testimonials from our clients to demonstrate our expertise in the banking industry.

By partnering with Saypr, you can gain access to a team of experienced and skilled professionals who understand the banking industry. We can help you develop innovative solutions that meet your business goals and provide you with the peace of mind that your applications are secure and reliable. We also offer competitive pricing and flexible engagement models to fit your needs.

The cost of developing a banking application will vary depending on the complexity of the project, the features you require, and the development team you choose. We provide transparent pricing and will work with you to develop a budget that meets your needs. We also offer flexible payment options to make the process easier for you.

Developing banking applications presents unique challenges, including security, compliance, scalability, and user experience. Saypr has the experience and expertise to overcome these challenges and deliver a successful solution. We have a deep understanding of the banking industry and the regulatory environment, and we use our knowledge to develop solutions that meet your specific needs.

The banking industry is constantly evolving, with new technologies emerging all the time. Some of the latest trends include artificial intelligence, blockchain, and open banking. Saypr stays up-to-date on these trends and can help you incorporate them into your banking applications.

Saypr offers a comprehensive suite of banking services, including mobile banking app development, online banking platform design, payment gateway integration, and fraud detection systems. We can help you create a digital experience that meets the needs of your customers and keeps their data safe and secure. We also offer consulting services to help you understand the latest trends in the banking industry and develop a strategy to stay ahead of the competition.

Our development process for banking applications is highly collaborative and iterative. We start by understanding your business goals and requirements. Then, we design and develop a solution that meets your specific needs. We use agile methodologies to ensure that we are constantly delivering value and meeting your expectations. Throughout the development process, we keep you informed of progress and provide regular updates.

The future of banking technology is exciting, with new technologies and innovations emerging all the time. We believe that the future of banking will be driven by personalization, convenience, and security. Saypr is committed to helping banks embrace these trends and develop solutions that meet the needs of their customers in the future.

The timeline for developing a banking application will depend on the complexity of the project and the resources available. We will work with you to develop a realistic timeline and provide regular updates on progress. We also use agile methodologies to ensure that we are delivering value and meeting your expectations in a timely manner.