Crypto

Navigating the world of crypto can be complex. At Saypr, we help you build a strong foundation, whether you're launching a new crypto project or looking to revamp your existing platform. We offer end-to-end solutions, from smart contract development and decentralized app (dApp) creation to security audits and marketing strategies. Let us guide you through the intricacies of blockchain technology and help you achieve your crypto goals.

Comprehensive Support

We offer ongoing support and maintenance for your crypto project, ensuring its smooth operation and continuous improvement. From security audits and bug fixes to feature enhancements and marketing strategies, we're here to help you succeed in the dynamic crypto landscape.

Expert Development

Our team of seasoned blockchain developers has extensive experience in building secure, robust, and scalable crypto solutions. We leverage the latest technologies and best practices to ensure your project is built with the highest standards of quality and efficiency.

Understanding Your Needs

We begin by deeply understanding your specific crypto project and its goals. We'll work closely with you to identify your target audience, desired functionalities, and any unique challenges you face. This allows us to craft a tailored solution that meets your exact requirements.

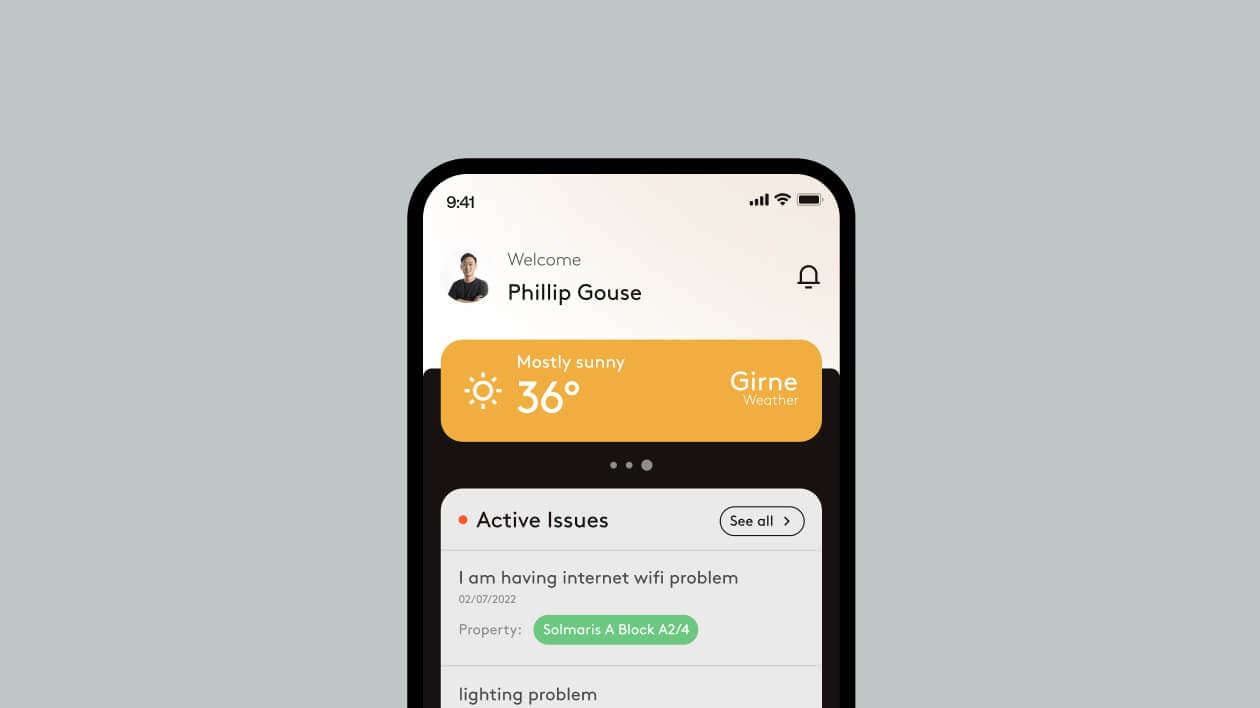

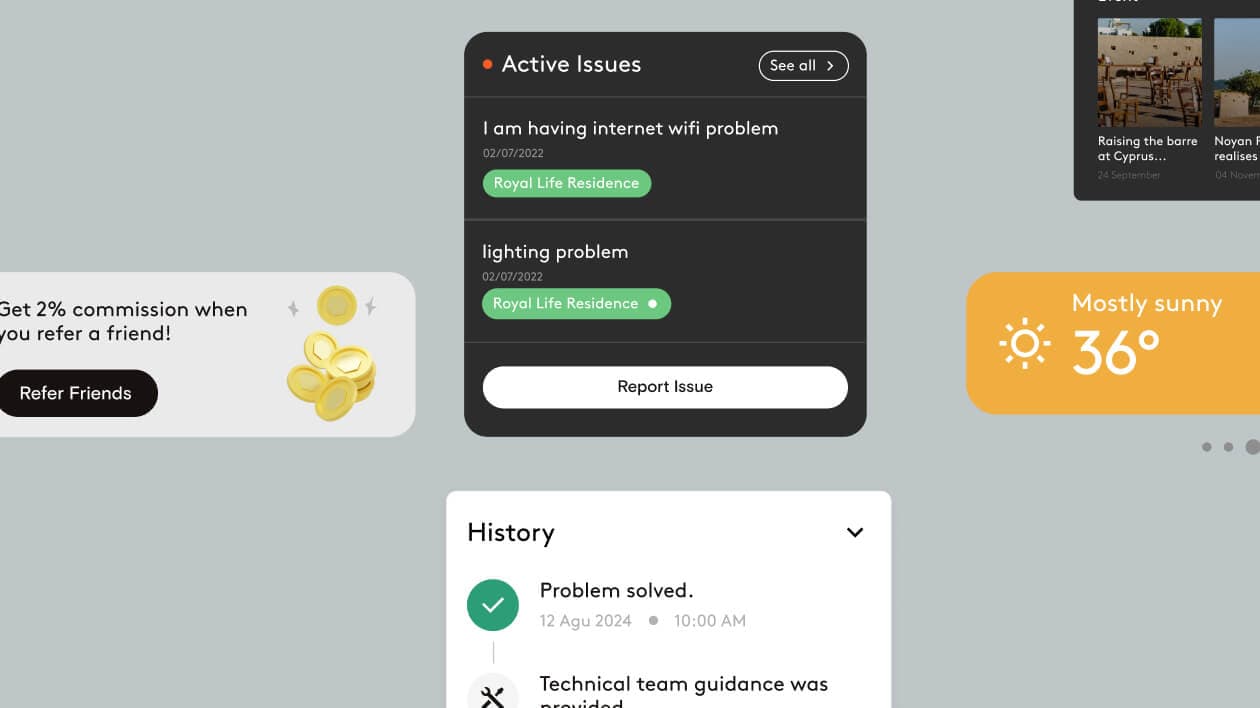

Design

We craft meaningful digital experiences that captivate and engage, blending creativity with strategy. From concept to execution, we make your brand stand out.

We shape distinctive brands that resonate, ensuring every element reflects your business’s core values.

Our branding process builds emotional connections, making your brand memorable and positioning it for long-term success in the market.

You can buy and sell cryptocurrencies through various platforms, including: * **Crypto Exchanges:** Platforms like Binance, Coinbase, and Kraken allow you to trade cryptocurrencies. * **Peer-to-Peer (P2P) Exchanges:** These platforms connect buyers and sellers directly, allowing for more flexibility in payment methods. * **Decentralized Exchanges (DEXs):** These exchanges operate on blockchain technology, offering greater privacy and control over your funds. When choosing a platform, consider factors like security, fees, and the availability of supported cryptocurrencies.

Securely storing your crypto is crucial to protect your assets from theft or loss. Here are some options: * **Hardware Wallets:** Physical devices that store your private keys offline, offering the highest level of security. * **Software Wallets:** Digital wallets that store your private keys on your computer or mobile device. * **Exchange Wallets:** Wallets provided by crypto exchanges, offering convenience but potentially compromising security. Choose the storage method that best suits your needs and risk tolerance.

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership of a specific item, such as artwork, collectibles, or even virtual real estate. They are built on blockchain technology, which ensures their authenticity and scarcity. Key features of NFTs include: * **Uniqueness:** Each NFT is one-of-a-kind, making it distinct from other NFTs. * **Indivisibility:** NFTs cannot be divided or split into smaller units. * **Proof of Ownership:** The blockchain records the ownership history of an NFT, providing clear proof of authenticity. * **Digital Scarcity:** The limited supply of NFTs creates scarcity, driving up their value. NFTs are transforming the way we think about digital ownership, creating new opportunities for artists, collectors, and businesses.

Smart contracts are self-executing agreements written in code and stored on a blockchain. They automate the execution of agreements according to predefined rules, eliminating the need for intermediaries. In the crypto world, smart contracts have numerous applications: * **Decentralized Finance (DeFi):** Enable lending, borrowing, and trading of crypto assets without traditional financial institutions. * **Non-Fungible Tokens (NFTs):** Create unique digital assets that can represent artwork, collectibles, or even real-world assets. * **Decentralized Exchanges (DEXs):** Facilitate peer-to-peer trading of crypto assets without the need for centralized platforms. * **Supply Chain Management:** Track goods and materials throughout the supply chain, ensuring transparency and accountability. Smart contracts are revolutionizing how we interact with technology and finance, enabling trustless and automated transactions on the blockchain.

There are numerous resources available for learning more about crypto: * **Online Courses:** Platforms like Coursera, edX, and Udemy offer courses on blockchain technology, cryptocurrency, and DeFi. * **Crypto Communities:** Join online communities and forums, such as Reddit and Telegram, to connect with other crypto enthusiasts and learn from their experience. * **Crypto News Websites:** Stay updated on the latest news and developments in the crypto space by following reputable news websites. * **Crypto Blogs and Articles:** Read blogs and articles written by experts in the crypto industry to gain insights into different aspects of the space. * **Books:** Numerous books have been written on blockchain technology, cryptocurrency, and DeFi, providing a comprehensive understanding of the subject.

Decentralized exchanges (DEXs) offer several advantages over traditional, centralized exchanges: * **Decentralization:** DEXs operate on blockchain technology, eliminating the need for a central authority, making them more resistant to censorship and manipulation. * **Privacy:** DEXs typically do not require users to provide personal information, enhancing privacy. * **Security:** DEXs are less vulnerable to hacks and fraud due to their decentralized nature. * **Control Over Funds:** Users retain control over their private keys, reducing the risk of losing funds due to exchange security breaches. * **Access to New Assets:** DEXs often offer access to a wider range of cryptocurrencies and tokens. However, DEXs can be more complex to use than centralized exchanges, and they may have lower liquidity.

Hardware wallets offer several advantages for storing your crypto securely: * **Offline Storage:** Your private keys are stored on a physical device, making them inaccessible to hackers online. * **Enhanced Security:** Hardware wallets are designed with robust security features, such as tamper-resistant chips and encryption. * **Peace of Mind:** Knowing your crypto assets are stored offline provides greater peace of mind. * **Suitable for Long-Term Storage:** Hardware wallets are ideal for storing crypto assets for extended periods, as they are less prone to vulnerabilities compared to software wallets. However, hardware wallets can be expensive, and you need to be careful not to lose the device as it's the only way to access your funds.

Software wallets offer several advantages: * **Convenience:** They are accessible on your computer or mobile device, making it easy to manage your crypto. * **Versatility:** Software wallets often support a wide range of cryptocurrencies. * **Free or Low-Cost:** Many software wallets are free or available at a low cost. * **User-Friendly Interfaces:** Software wallets typically have intuitive interfaces, making them easy to use. However, software wallets are more vulnerable to hacking than hardware wallets, as they are connected to the internet.

Cryptocurrencies offer several potential benefits: * **Decentralization:** They operate independently of central authorities, reducing the risk of censorship or manipulation. * **Security:** Cryptographic techniques ensure the security of transactions and protect against fraud. * **Transparency:** All transactions are recorded on a public ledger, providing a transparent and auditable history. * **Accessibility:** Cryptocurrencies can be accessed globally, allowing for cross-border payments and financial inclusion. * **Innovation:** The blockchain technology underlying cryptocurrencies is driving innovation in various sectors, from finance to supply chain management. However, it's important to note that cryptocurrencies are also associated with certain risks, such as price volatility and security concerns.

Centralized exchanges (CEXs) and decentralized exchanges (DEXs) differ in their structure, operation, and features: **Centralized Exchanges (CEXs):** * **Centralized Authority:** A single entity controls the exchange, managing user accounts, funds, and order matching. * **Custodial:** Users deposit funds into the exchange, giving the exchange control over their assets. * **Higher Liquidity:** CEXs typically have higher liquidity, making it easier to buy and sell crypto. * **Easier to Use:** CEXs are generally simpler to use than DEXs. **Decentralized Exchanges (DEXs):** * **Decentralized Network:** DEXs operate on blockchain technology, eliminating the need for a central authority. * **Non-Custodial:** Users retain control over their private keys, ensuring they have full control over their assets. * **Lower Liquidity:** DEXs typically have lower liquidity compared to CEXs. * **More Complex to Use:** DEXs can be more challenging to use for beginners due to their technical nature. Choose the type of exchange that best suits your needs and risk tolerance.

There are several categories of cryptocurrencies, each with its unique features and applications. Some of the most common types include: * **Bitcoin (BTC):** The original and most well-known cryptocurrency, known for its decentralized nature and limited supply. * **Ethereum (ETH):** A platform that allows developers to build and deploy decentralized applications (dApps). It's known for its smart contract functionality, allowing for automated agreements on the blockchain. * **Stablecoins:** Cryptocurrencies pegged to a stable asset, like the US dollar, to minimize price volatility. * **Meme Coins:** Cryptocurrencies often based on internet memes or cultural phenomena, often with a focus on community engagement. * **Utility Tokens:** Tokens that provide access to a specific service or platform, such as discounts or voting rights. This is just a glimpse into the diverse world of cryptocurrencies. It's constantly evolving, with new types emerging frequently.

There are several types of crypto wallets, each with its strengths and weaknesses: * **Hardware Wallets:** Physical devices that store your private keys offline, offering the highest level of security. Examples include Ledger Nano S and Trezor. * **Software Wallets:** Digital wallets that store your private keys on your computer or mobile device. Examples include Exodus, Electrum, and Mycelium. * **Exchange Wallets:** Wallets provided by crypto exchanges, offering convenience but potentially compromising security. Examples include Binance Wallet and Coinbase Wallet. * **Paper Wallets:** A printed piece of paper containing your private keys, offering offline storage but susceptible to physical damage. Choose the type of wallet that best suits your security needs and preferences.

While crypto offers potential benefits, it's essential to be aware of the risks involved: * **Price Volatility:** Cryptocurrency prices can fluctuate dramatically, leading to potential losses for investors. * **Security Risks:** Crypto wallets and exchanges can be vulnerable to hacking, and lost private keys cannot be recovered. * **Regulatory Uncertainty:** The regulatory landscape for crypto is still evolving, which can create uncertainty for businesses and investors. * **Scams and Fraud:** The decentralized nature of crypto can make it easier for scams to flourish. * **Limited Adoption:** While adoption is increasing, cryptocurrencies are still not widely accepted as a form of payment. It's crucial to conduct thorough research and understand the risks before investing in crypto.

While NFTs offer exciting opportunities, it's important to be aware of the risks involved: * **Volatility:** The value of NFTs can fluctuate significantly, leading to potential losses for investors. * **Scams and Fraud:** The popularity of NFTs has attracted scammers, who may create fake NFTs or manipulate prices. * **Limited Market Liquidity:** Some NFTs may be difficult to sell, especially if there is no active market for them. * **Environmental Concerns:** The energy consumption associated with some blockchain networks can be significant, raising environmental concerns. It's crucial to conduct thorough research and understand the risks before investing in NFTs.

NFTs have numerous applications beyond digital art and collectibles: * **Gaming:** NFTs can represent in-game items, such as characters, weapons, and virtual land, creating a new economy within games. * **Music:** Musicians can use NFTs to sell exclusive tracks, albums, or even virtual concert tickets. * **Real Estate:** NFTs can represent ownership of virtual or even physical real estate, allowing for fractional ownership and new investment opportunities. * **Supply Chain Management:** NFTs can track goods and materials throughout the supply chain, ensuring transparency and authenticity. * **Identity Management:** NFTs can be used to create secure and verifiable digital identities. The potential applications of NFTs are vast and continue to expand as the technology evolves.

A blockchain is a distributed, immutable ledger that records transactions in a secure and transparent manner. It's like a chain of blocks, each containing a record of transactions. Once a block is added to the chain, it cannot be altered or deleted. This makes it highly secure and resistant to tampering. Here's how it works: 1. **Transaction Initiation:** When a transaction occurs, it's broadcast to the network of computers (nodes) that maintain the blockchain. 2. **Validation:** Nodes verify the transaction and add it to a block. 3. **Block Creation:** Once a block is filled with transactions, it's added to the blockchain. 4. **Chain Extension:** The new block is linked to the previous block, creating a chronological chain of records. This process ensures that all transactions are transparent, verifiable, and tamper-proof.

A crypto wallet is a software program or physical device that allows you to store, send, and receive cryptocurrencies. It's essentially a digital container for your crypto assets. When choosing a wallet, consider the following factors: * **Security:** Look for wallets with strong security features, such as multi-factor authentication and cold storage options. * **Compatibility:** Ensure that the wallet supports the cryptocurrencies you plan to use. * **User-friendliness:** Choose a wallet with an intuitive interface and easy-to-use features. * **Fees:** Compare the transaction fees charged by different wallets. There are various types of wallets available, including hardware wallets, software wallets, and exchange wallets. Choose one that aligns with your security needs and preferences.

Cryptocurrency, or crypto, is a digital or virtual currency that uses cryptography for security. It operates independently of central banks and governments, relying on a decentralized network for transactions. Think of it like a digital ledger, where every transaction is recorded and verified by a network of computers, ensuring transparency and security. The most popular example is Bitcoin, but there are many other cryptocurrencies available.

Decentralized Finance (DeFi) is a rapidly growing sector within the crypto space that aims to replace traditional financial institutions with blockchain-based solutions. DeFi applications allow users to access financial services, such as lending, borrowing, and trading, without relying on intermediaries. Key features of DeFi include: * **Transparency:** All transactions are recorded on a public blockchain, ensuring transparency and accountability. * **Open Access:** Anyone with an internet connection can access DeFi services, regardless of their location or credit history. * **Security:** Blockchain technology provides security and immutability to DeFi applications. * **Innovation:** DeFi is constantly evolving, with new protocols and applications emerging frequently. DeFi is still in its early stages, but it has the potential to revolutionize the financial system.

The future of crypto is uncertain but full of potential. Here are some predictions: * **Increased Adoption:** Cryptocurrencies are expected to become more widely accepted as a form of payment, both online and in physical stores. * **Growth of DeFi:** Decentralized finance is poised to continue its rapid growth, offering innovative financial services to a wider audience. * **Expansion of NFTs:** Non-fungible tokens are expected to find new applications in various industries, creating new opportunities for artists, collectors, and businesses. * **Regulatory Clarity:** Governments around the world are expected to provide more clarity on regulations for cryptocurrencies, fostering greater confidence and investment. The future of crypto is likely to be shaped by technological advancements, regulatory developments, and public adoption. It's an exciting space to watch, with the potential to transform various aspects of our lives.